Cash Collection for SMEs - How to Ensure Success

Introduction

As the owner, manager, or even an employee of a small business, you've certainly got plenty of better things to do with your precious time than chasing customers to get paid.

However, it's a sad fact of business life that many customers will only pay once they've been reminded, and some will need more encouragement than that!

If your business is too small to justify having a specialist credit controller, the important task of making sure that there is enough cash coming into the bank account each month falls on the business owner or financial controller.

But what are the skills and methods that such individuals need to be aware of so as to ensure success?

The webinar is suitable for anyone working within an SME and with an interest in financial control and cash collection.

It is designed to look at current trends and habits, as well as focus on best practice and hints and tips to ensure SMEs make the most of their internal cash collection processes.

What You Will Learn

This webinar will cover the following:

- A look at the current financial market, analysing the trends occurring amongst businesses and individuals when it comes to financial security, prioritising payments, and outstanding debt

- Can't pay or won't pay? How to understand your clients and those that owe you cash, then using this knowledge to aid the recovery process

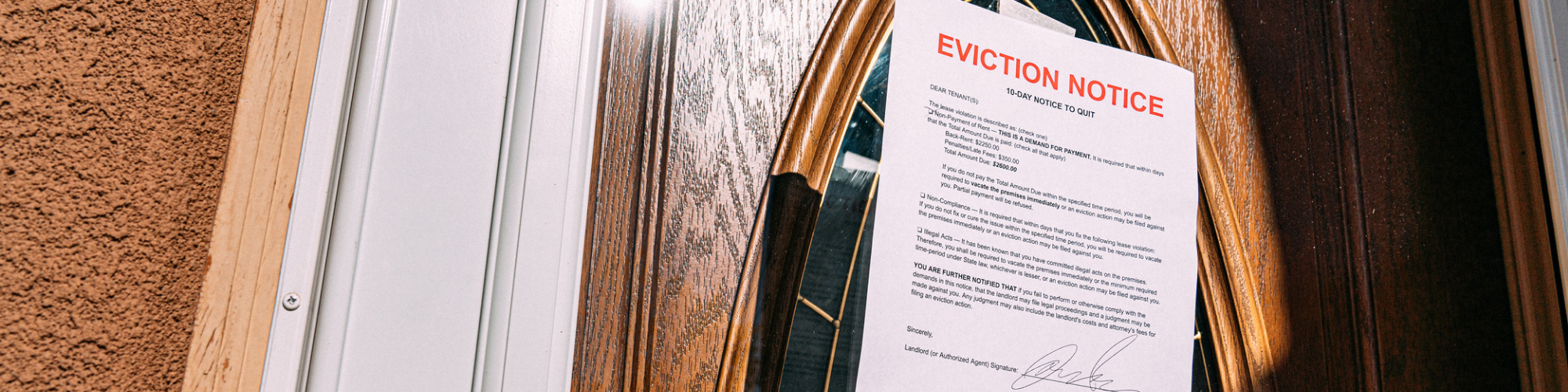

- Get your paperwork in order. A look at payment terms and contracts and how to ensure these are drafted to protect your position

- Preparing a recovery timeline for your business

- The court process - at what stage is it necessary to go legal and the process involved

- Hints and tips as to how to ensure success

This webinar was recorded on 17th April 2023

You can gain access to this webinar and 1,700+ others via the MBL Webinar Subscription. Please email [email protected] for more details.